In 2025, a clear shift is underway in Pakistan’s automotive market. While sedans like the Corolla, Civic, and Yaris were once seen as the ultimate aspiration for middle-class buyers, the balance of power has changed. Small cars—especially hatchbacks and compact crossovers—are now dominating sales charts across major cities. From Suzuki Alto to Kia Picanto and even Chinese entries like Prince Pearl, these vehicles are becoming the first choice for daily drivers. But why are Pakistanis moving away from sedans? Let’s explore the factors reshaping driving preferences across the country.

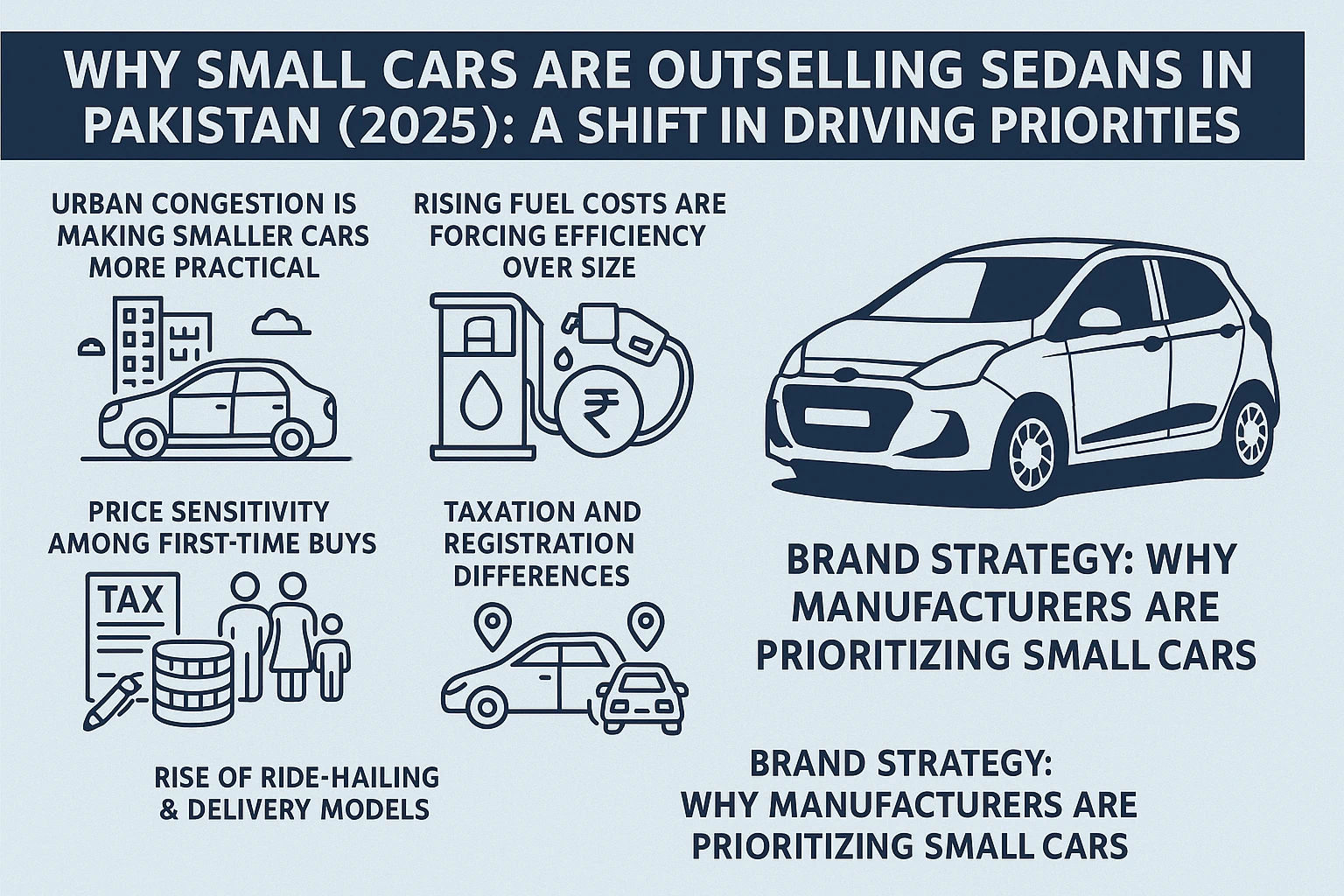

Urban Congestion Is Making Smaller Cars More Practical

Pakistan’s cities weren’t built for the kind of traffic they now see daily. In places like Lahore, Karachi, and Rawalpindi, road congestion, illegal parking, and narrow streets are the norm. For drivers navigating tight neighborhoods or commercial zones, small cars offer a much easier and less stressful experience. They fit into tighter parking spaces, take less room in traffic, and allow for better maneuverability in chaotic conditions. With infrastructure upgrades lagging behind population growth, compact vehicles have become a survival tool more than a preference.

- City road networks are becoming increasingly choked during peak hours

- Parking availability favors hatchbacks and compact vehicles

- Easier for women, young drivers, and daily commuters to handle in tight areas

For urban residents, owning a small car isn’t just smart—it’s necessary.

Rising Fuel Costs Are Forcing Efficiency Over Size

Fuel prices in Pakistan have remained volatile over the last few years, and by 2025, they’ve reached a point where engine size directly impacts a car’s feasibility for most households. The larger the car, the more fuel it burns—simple math. Small cars, often running 660cc to 1000cc engines, deliver far better mileage than traditional sedans. That matters immensely for middle-class drivers commuting daily or using their vehicles for ride-hailing and delivery work.

- Suzuki Alto and Kia Picanto regularly deliver 16–18 km/l in city traffic

- Fuel-efficient cars are now marketed heavily with “mileage-first” branding

- Hybrid sedans are too expensive; small petrol cars fill the affordability gap

For fuel-conscious Pakistani buyers, small cars aren’t just economical—they’re essential.

Price Sensitivity Among First-Time Buyers

In today’s economic climate, affordability isn’t a feature—it’s the deciding factor. With rising inflation, a devalued rupee, and increasing car loan interest rates, the average Pakistani buyer is more cost-sensitive than ever. First-time buyers, especially in cities, are opting for vehicles that don’t strain their monthly budgets. Small cars like the Suzuki Alto VXR, United Bravo, and Prince Pearl fit that niche perfectly. They come with lower down payments, lower monthly EMIs, and reduced maintenance costs compared to sedans.

- Entry-level cars start as low as PKR 1.6–2.5 million vs. sedans starting above PKR 4 million

- Smaller cars qualify for more accessible leasing options and shorter approval times

- Lower parts and service costs for Chinese and locally assembled hatchbacks

With financial stress at an all-time high, small cars are becoming the go-to option for families and individuals alike.

Shift in Family Size and Use Case

Another key reason sedans are losing ground is the changing structure of households and lifestyle needs. The once-common joint family system is giving way to nuclear family units, especially in urban centers. Today’s drivers don’t need large backseats and big trunks—they need fuel efficiency, AC that works, and a car that fits in their apartment’s parking lot. Add to that the rise in solo commuting and fewer out-of-city family trips, and sedans start to feel excessive for the average use case.

- Nuclear families and working individuals prefer practical daily drivers

- Fewer people doing long-distance family trips due to fuel costs and better bus services

- Small car now seen as “smart” rather than “compromise”

The emotional pull of buying a big sedan is being replaced by the practical satisfaction of buying what actually fits your life.

Taxation and Registration Differences

Car ownership in Pakistan isn’t just about the sticker price—it’s about what you’ll keep paying afterward. Government tax policies strongly favor smaller vehicles, making them cheaper not just to buy, but to own. Cars under 1000cc often qualify for lower registration fees, reduced token taxes, and, in some cities, even preferential parking or entry permissions. These differences may not seem huge individually, but they add up quickly—especially when you’re budgeting month to month.

- Small cars have significantly lower annual token taxes (under PKR 2,000 in some provinces)

- Initial registration is cheaper for 660cc–1000cc cars compared to 1300cc+ sedans

- Reduced withholding tax brackets for filers buying economy cars

Policy and regulation are effectively steering the average buyer toward smaller, more efficient vehicles—without needing a government incentive scheme to make it obvious.

Rise of Ride-Hailing & Delivery Models

Another major force behind the rise of small cars in Pakistan is the booming gig economy. Ride-hailing platforms like Careem, InDrive, and Bykea, along with food delivery services, have created massive demand for fuel-efficient, low-maintenance vehicles. For thousands of daily-wage earners and freelancers, the car isn’t just transportation—it’s a source of income. And in that equation, every kilometer and every liter of petrol counts. Hatchbacks are dominating these fleets because they offer the best balance of fuel economy, ease of repair, and affordability.

- Suzuki Alto and WagonR are top picks for ride-hailing due to low running costs

- Easy availability of spare parts and mechanics for small cars across urban centers

- Leasing programs designed specifically for gig workers favor compact cars

In many cases, the “business model” of gig work simply doesn’t support a sedan anymore—compact is king.

Brand Strategy: Why Manufacturers Are Prioritizing Small Cars

Car makers follow the money—and in 2025, the money is clearly in compact vehicles. Local assemblers like Suzuki, Kia, Changan, and newcomers like United Auto are focusing their efforts on sub-1000cc models that match current consumer demand. Even brands traditionally known for sedans, like Toyota, are now putting more visibility behind smaller variants like the Yaris or even imported hatchbacks. The reason is simple: small cars are selling, and manufacturers want to build where the volume is.

- Suzuki dominates market share with Alto and WagonR variants

- Newer players like Prince and United are focused entirely on low-cost hatchbacks

- Local production constraints favor small, high-turnover models over complex sedans

With import restrictions and rising material costs, companies are scaling down their ambitions—and up their focus on volume-driven, small-format vehicles.

Conclusion

Pakistan’s auto market in 2025 is undergoing a real transformation. The sedan, once a symbol of middle-class success, is now being passed over in favor of compact, efficient, and financially accessible cars. From economic pressures and urban realities to changing lifestyles and smart consumer behavior, the rise of small cars reflects a deeper shift in priorities.

The verdict is clear: owning a big car no longer defines status—owning the right car for your needs does. For manufacturers, financiers, and consumers alike, embracing this new reality means making smarter, leaner, and more sustainable choices on four wheels.